Stamp Duty – What is it? Who Pays & Who is Exempt? (AD)

Buying a home is probably one of the biggest financial investments anyone can make, so it’s vitally important to consider all the costs involved. Solicitors, conveyancers, estate agents, removal companies and mortgage arrangement fees all take a heavy toll on the finances during this process, but one of the biggest costs is Stamp Duty. But what is Stamp Duty and how does it apply (or not) to the situations of many in the UK? Read on to find out about the changes since October 1st 2021 when the Stamp Duty Land Tax Holiday finished.

What is Stamp Duty?

In it’s simplest terms, Stamp Duty is a tax that most are liable for when buying land or property. It can vary depending on a number of factors I’ll mention below, but it is likely to be the biggest consideration most buyers will need to factor in with rates changing from October 1st 2021 on properties and land more than £125,000.

As part of the purchase process for land and property, solicitors and conveyancers will normally handle and pay SDLT on your behalf and then invoice you. It must be paid in full and not in instalments within 14 days of the ‘effective’ completion date (30 days in Scotland). Even though a solicitor may pay the tax, it’s important to make sure the payment goes through as the buyer may be liable for charges if this is missed.

How Much are Stamp Duty Rates in the UK?

Scotland and Wales have their own tiers and rates for ‘Stamp Duty’ and refer to them, respectively, as the Land & Buildings Transaction Tax (LBTT) and Land Transaction Tax (LTT). For the purposes of this article, I’ll be dealing with the Stamp Duty Land Tax (SDLT) which is payable on acquired property in England and Northern Ireland. As mentioned above, this starts at land and property worth more than £125k and is illustrated in my table below

How much is stamp duty first-time buyers?

First time buyers are the main difference to the £125,000 starting threshold mentioned earlier. Since July 2021, first-time buyers have been able to enjoy no SDLT up to £300,000 and will ‘only’ need to pay 5% of the SDLT on the remaining portion from £300,001 to £500,000.

A first-time buyer, in the UK, is categorised as an individual who has never owned or had an interest in a residential property. This could be anywhere in the world, not just the UK. It applies where the intent is to occupy as a main residence.

Other Factors for Stamp Duty costs include:

- Where your property is located geographically

- Whether you are a first-time buyer

- The value or purchase price of the property

- Whether the property is a second home or non-main residence

There are a number of great valuation portals out there right now including Yopa, Zoopla and even the Land Registry. These will help those looking to buy and sell know some approximate figures when then accessing Stamp Duty Calculators and considering mortgages and applications.

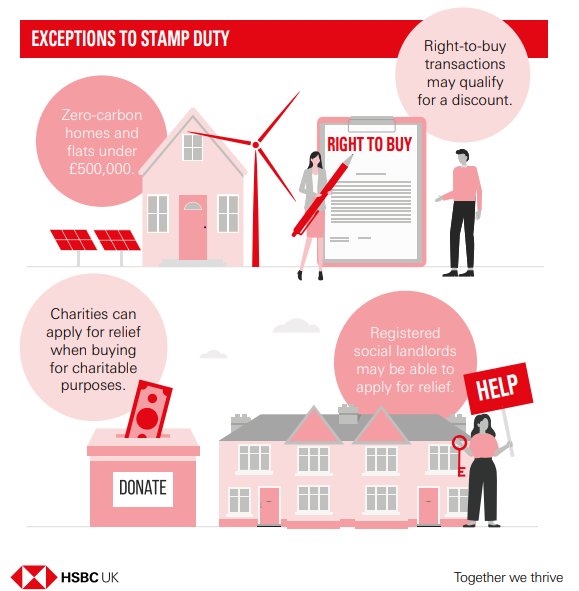

Are There Exemptions and Discounts to Stamp Duty?

Zero carbons flats and homes – In late 2007 regulations came into place that a lot some relief to the first property bought by an investor or individual homebuyer that is “Zero-carbon”. The Zero Carbon Homes Relief guidance states that properties (including flats) up to the value of £500,000 would not be liable for SDLT if the properties met an agreed standard in environmental efficiency. Even for homes and flats over the £500k threshold, there would still be a healthy £15,000 discount applied to any taxes charged – so long as the efficiency criteria are still met.

Essentially, a zero carbon home can be connected to mains electricity and gas but will need to generate enough renewable energy and use high-efficiency products like triple glazing and extra insulation to make a year’s worth of living net neutral.

Some Right-to-buy transactions – There are various situations for those in the council tenancy and public tenancy areas. In simplistic terms, the longer a tenant is based in a given property the larger the Stamp Duty Relief will be. Outside of London, this can represent a SDLT discount of up to £84,600 at the time of writing this article (£112,800 for properties located in London). Checking out the Government’s own Right to Buy Calculator will give those looking to assess their situation a guiding set of figures for their own circumstances.

Properties bought by charities for a charitable purpose and use – This can be a little unclear, but HMRC would usually consider relief or exemption for the purchase of property by a charity for charitable purposes. In theory, the charity must be registered with the Charity Commissioners in England and Wales or recognised as a charitable endeavour by HMRC Charities in Scotland or Northern Ireland. In practice, however, the HMRC also works with those that are not registered such as churches and charities based around faith, social and community groups.

There are strict guidelines and rules in place to make sure the properties and land are not then used for non-charitable purposes and these disqualifying events may result in relief being withdrawn by HMRC.

Social landlords that are registered as such, can also apply for an exemption discount in a manner similar to charitable trusts. They would need to consult the HMRC SDLT Manual for more details relating to their portfolio and transactions.

Other Exemptions – There are a whole host of other common-sense exemptions to the SDLT, including properties left in wills, transferred as a result of dissolution or passed between individuals as no-cost agreements. See the HMRC website for a full list of reliefs and exemptions for SDLT.

Disclosure: This is an HSBC sponsored article. I am not a financial advisor and this article is not financial advice. Always consult a qualified financial expert when making decisions that may affect your finances.