How to give families with spiraling debt a “Breathing Space”

This article is in support of The Children’s Society and as part of Place2Be’s #childrensmhw

Whatever age you are within a family you’ll have a concept of “need”. Whether a baby craving milk, a toddler reaching for a hug, or a parent doing what they can to put food on the table. We often wrongly live beyond our means, not always considering what is essential to our lives. But even for those who are cautious, unforeseen events can snatch our safety nets away and leave us in the debt trap.

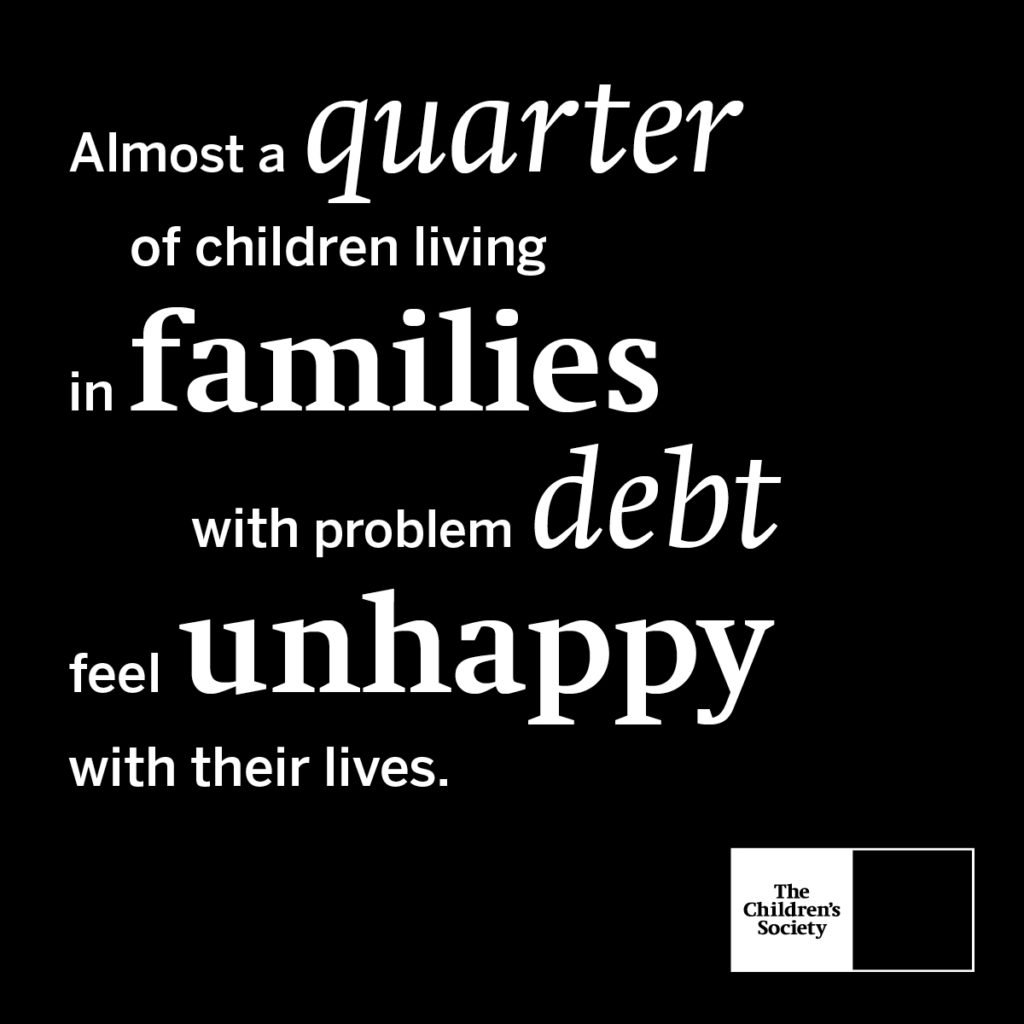

With money and mental health so closely linked to each other, it seemed right to lend my support to The Children’s Society during#childrensmhw (Children’s Mental Health Week). The charity is petitioning the Government to give families “Breathing Space”; a period of time where debts can be frozen, before they spiral out of control.

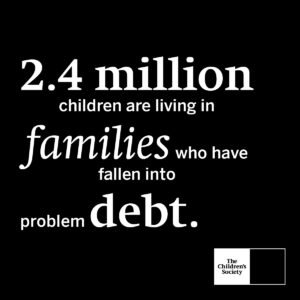

2.4 million families across the UK struggle with the debt trap. Job loss, injury, and even just the rising price of living can tip the balance of what a family can cope with. Once the debt starts to become an issue, families need to know how to get help. They need advice. They need that breathing space…

What can we do to help?

I’ve been trying to raise awareness of The Children’s Society campaign. We’re working to get 1000 signatures to call on the government to give families that have fallen into debt the time and space they need to get advice and form a plan to build their way back out. To give families a period of time where loan company adverts aren’t a last desperate resort. To stop bailiffs beating at the door of a family already struggling to financial, and mentally, survive.

The petition looks to suggest a period where a plan is put in place and…

- debts are frozen and free of rising fees. This would allow a fragile family time to work together, with support, to approach debt rationally and safely.

- a “hold” is placed on enforcement action, meaning vulnerable children are not intimidated.

- a debt repayment plan is but in place based on the circumstances of the family.

All you need to do to support the petition is add your name to the petition on The Children’s Society Campaign Page

It doesn’t cost you anything, all it needs is 30 seconds to lend your support. Please… do just that one thing, before reading on, by clicking above.

Make a plan…

I said at the beginning of this article that sudden changes can hit ANY family. In the Savvy household, the trickiest time has been working as a family to afford Mrs Savvy in taking a full years’ maternity leave. That’s been tricky enough, without added unforeseen pressures. But it could have been different. Our boiler has had 10 engineer visits over the past 14 months for new pumps, circuit boards, capacitors and more; if we hadn’t had boiler cover it would have cost us £1000’s.

For some families, boiler cover might be beyond their means, so you can see how unexpected debt can suddenly raise it’s ugly head. If I can give just one parting tip for this article it would be to take that time to finally consider “what if?”

Make that will that you’ve been putting off; consider Will-Aid month. Cancel non-essential luxuries that aren’t used like multiple TV subscriptions. Monitor direct debits and check contract end dates. Check those groceries are well used and not wasted. Compare insurance covers. Above all remember, if the debt trap does come calling, do not suffer in silence.

The Children’s Society have an acronym:

D: Don’t keep it to yourself.

E: Embarrassment; it happens along with many other emotions when coping with debt. Speak out and don’t think you’re alone. 2.4 millions others are tackling the same issues.

B: Beware of private companies; use reputable debt advisory. One of our favourite sites is Debt Camel, great non-jargon signposting to advice and support.

T: Take control, consider advise from free debt charities like Step Change

2 Comments