Multi Cover Insurance – What is it and how does it work? (AD)

I’m more than familiar with multi cover insurance products. Having grown up in a household with multiple members and cars it became commonplace to seek out an amazing all in one insurance product that covered the household’s cars. However, increasingly of late, I’ve been impressed by the joined-up thinking from insurers offering more and more options to insurance products that can be added to a multi cover plan. Not only can this make organizing, modifying and paying for the insurance products easier, but it can also help ensure the products you have will suit your whole family and their household needs.

What is covered in a multi cover insurance product?

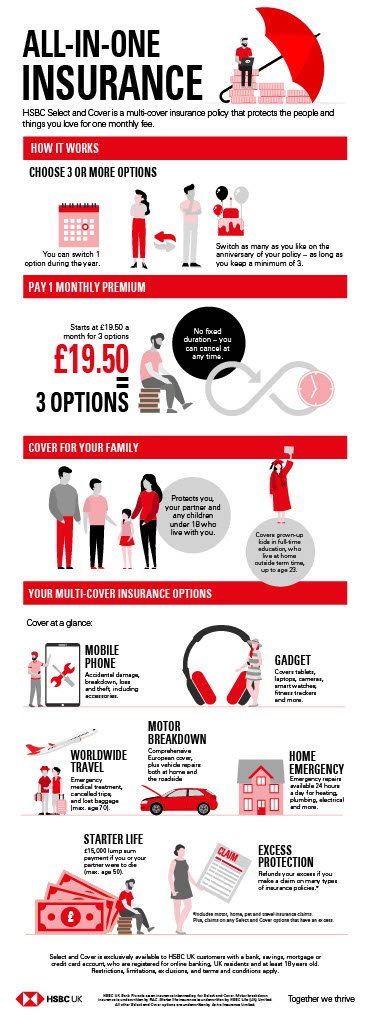

One such provider of this modern insurance approach is HSBC UK. Their Select and Cover offering is exclusively available to HSBC customers within the UK who are registered for online banking. The only restriction in terms of applications is a minimum age of 18 for UK residents, but don’t worry as the general “family” product gives you peace of mind as the cover for the family includes your partner and any children under 18 who live with the applicants.

In addition to this, the multi cover insurance option also includes any children under 23 who are in full-time education but are usually home when it is not term time. On top of this base family insurance promise, you can then choose a minimum of 3 and up to 7 insurance cover options.

How much does a multi cover insurance product like Select and Cover cost?

It is always worth comparing the terms and conditions of your existing policies with those of any new cover you investigate. Plus, make sure you’re not duplicating cover – ie. you’re not paying to cover your mobile if you already have it as part of your mobile plan or bank account, for example.

Prices with HSBC multi cover insurance, Select and Cover, start from a reasonable £19.50 a month for 3 options, equating to £234 a year. Each additional option after that starts from an extra £78 per year, or an extra £6.50 per month

Price break down for Select and Cover costs.

£26.00 for 4 options (£312 a year)

£32.50 for 5 options (£390 a year)

£39.00 for 6 options (£468 a year)

£45.50 for all 7 options this includes (£546 a year)

Why it’s worth considering a muli cover insurance like Select and Cover

At the time of writing, HSBC customers choosing to take out a Select and Cover multi insurance policy can also claim a reward such as a £40 Argos e-gift card, a Tile Starter Pack to help you locate your keys and wallet, or a 3-month BakedIn subscription. Note, T&Cs apply and this offer could be withdrawn at any time.

You also have the flexibility to remove one option per year as long as you keep the minimum of three products within the multi cover insurance package. This means you can adapt the cover easily to the changing needs of your family, household and budget.

- Mobile Cover – I’ve always said it’s best to buy mobiles upfront, rather than buying into expensive contracts. But when you’ve saved up for a mobile phone bought outside of a contract, it can be tricky to rest at ease knowing how much you spent on a fragile piece of droppable tech! Including mobile cover in your all in one insurance options means you’re covered for the costs involved with losing or damaging your phone. HSBC’s cover includes up to 4 claims per year.

- Gadget Cover – As I’m regularly writing, typing and snapping photos on the go, this is a particularly useful option. I use an Olympus Pen EPL-10, a decent bit of photography kit, and that alone is worth having cover for when a full kit retails at £400-£600. Covers up to 4 gadget claims per year.

- Motor Breakdown – Whether at home, at the roadside, in the UK or even in Europe, this cover includes recovery assistance for the vehicle you are travelling in and is person-based. I love this as the cover goes where you go, perfect as you never know when you’ll need it.

- Home Emergency – Having been on the receiving end of burst water pipes I know how important decent emergency cover can be. Select and Cover offers peace of mind for heating systems and problems with your roof, drains and wiring to help deal with those hidden issues.

- Excess Protection – This product allows you to relax in the knowledge you’re not going to come undone with larger excess costs on other policies. It covers not only Select and Cover products, but also others you may already have such as pet and motor.

- Worldwide Travel – As the world, in some cases, starts to open up again to travellers, it’s great to know that HSBC’s offering includes coronavirus-related travel disruption cover. This cover is inclusive of family members and will cover you up to 70 years of age.

- Starter Life Insurance Cover – A simple fixed £15,000 lump sum if the unthinkable should happen to you, or your partner, up to the age of 50. This cover also includes £5,000 cover for children.

Is it for you?

If you’re wondering if an all in one multi cover insurance product like Select and Cover is for you, you might be best totting up a total of what you currently spend on individual policies. If they’re costing you more and covering less, then a move to a new setup, like Select and Cover, might be right for you. I can certainly see why those looking to cover all manner of needs can easily and quickly get the right cover they need for their family by taking out a policy today.

Terms, conditions, exclusions and limitations apply. HSBC UK Bank Plc acts as an insurance intermediary for Select and Cover. Motor breakdown insurance is underwritten by RAC. Starter life insurance is underwritten by HSBC Life (UK) Limited. All other Select and Cover options are underwritten by Aviva Insurance Limited.

This is a collaborative post. #Ad

The views within remain my own and are not financial advice. If you’re looking to make big decisions regarding your finances, always consult an independent financial advisor.

One Comment