How to make the most of mortgage overpayments with Sprive

As a dad of two young boys whose eyes widen when they see an amusement arcade, I know all too well the importance of making sure money isn’t wasted or surplus income taken for granted. Yes, it’s important for families to have memorable moments and experiences, but it’s not always about spending money – particularly if you have mortgage payments to make. I believe that financial stability and understanding of your income and outgoings leads to more independence and a better sense of financial well-being. And while it can be easy to get caught up in the daily grind of work and family life, I’ve found that taking control of my finances and considering tools like Sprive to automate saving for mortgage overpayments have not only helped me begin that road to financial independence, but also a sense of well-being and happiness.

The reason mortgage overpayments and Sprive are worth considering.

So why is overpayment so great? Well, for context, I’ve had a run of bad luck with cars over the last few years and decided to bite the bullet and buy a slightly more expensive, newer model car. It wasn’t new, but the Alfa Romeo I bought from Car Giant in London had low mileage, a good warranty and a good price, so I opted to use a credit agreement. This is not something I’d often do, but the budget I had at the time made it a viable option.

The relevance here is that my repayments were due over 24 months, but via overpayment, I clawed back interest and financial freedom which was positive for my finances and wellbeing. For many in the UK a mortgage is the only way to get on the housing ladder and, with terms often exceeding 25 years, they are hands down the biggest financial commitment a family is likely to make. This being said, I believe apps like Sprive that facilitate an individual to take back their financial independence via techniques like subtle mortgage overpayments are greatly needed in today’s fintech world.

Why do mortgage overpayments matter?

By overpaying my mortgage each month, I’m able to pay off my mortgage earlier and save thousands of pounds in interest over the long term.

But how exactly does this work? Well, according to recent research from the FIRE (Financial Independence, Retire Early) movement, paying just an extra £50 per month on a £150,000 mortgage with a 25-year term at a 3% interest rate can save you over £15,000 in interest and shave over three years off your mortgage term. That’s a huge amount of money and time that can be used for other things, like investing, providing for dependents, or even retiring early.

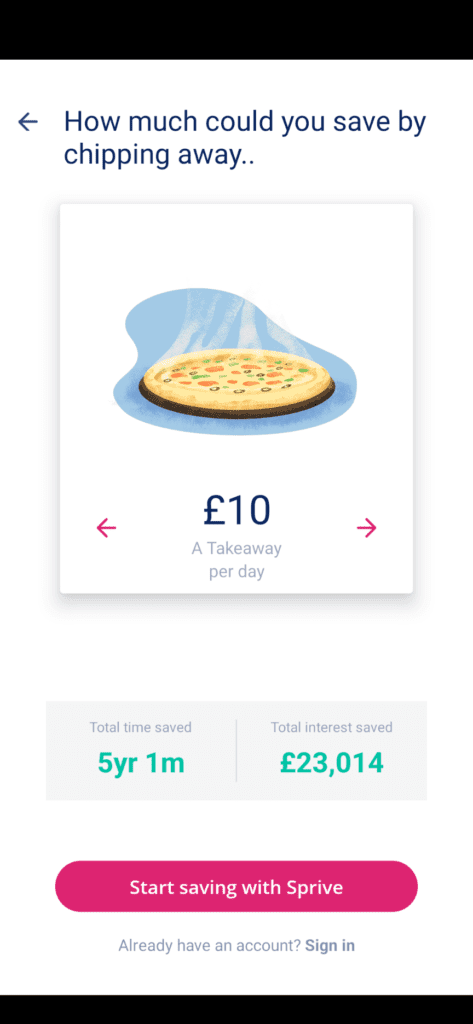

But I know what you might be thinking – where do I find the extra money to make these overpayments? That’s where budgeting and cutting out some of the small luxuries comes in. I say ‘some’ because as you may have read in my money-saving challenges, I believe any saving goal and method has to balance a target goal with human needs and motivations. By cutting back on a few things like the occasional daily cup of coffee, needed streaming services or an extra car wash when I can wash the car myself, I’ve been able to save a reasonable amount of money each month that I can then put towards my mortgage overpayments.

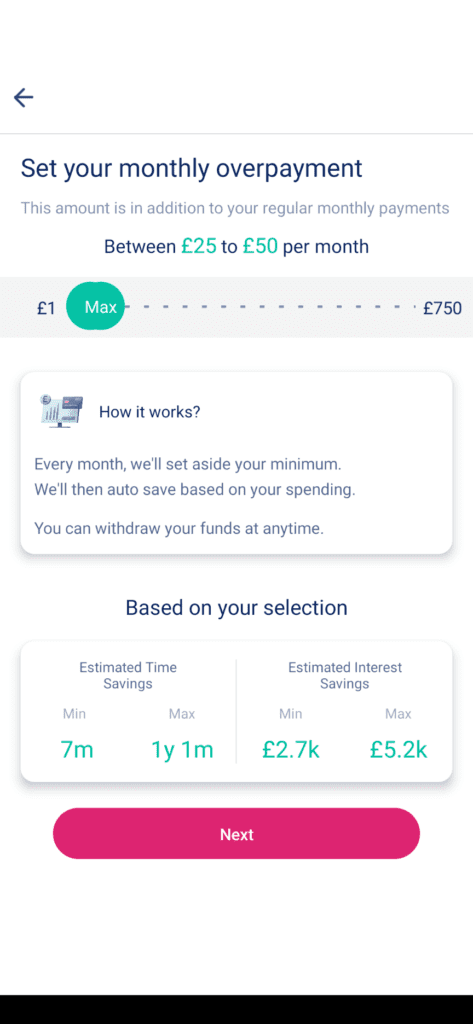

Fortunately, this is where the Sprive app I’ve mentioned makes overpaying a mortgage even easier. The app allows me to easily track my expenses, set budgets, and make overpayments directly to my mortgage lender (Nationwide in the UK, for example). It also offers features like notifications when I’m approaching my budget limit and the ability to see how much interest I’m saving over time, which helps me stay motivated and on track.

It made some assumptions about my mortgage type when signing up securely to link my bank account, like an awareness of the £500 Nationwide ERC limits relevant to my situation, but linked swiftly and flawlessly when setting up the app.

How does Sprive work to support a mortgage overpayment?

Sprive is a simple app with a really straightforward interface. If you’re ready to try chipping away at your outstanding mortgage in a transparent and manageable way, then look no further than Sprive! Their smart calculator makes it easy to figure out how much you need to save each month to reach your mortgage goals. During certain periods, when you sign up for the first time via the link and using the code below, Sprive may give you an additional free £5 bonus.

Here’s how to access the app in minutes:

- Choose Android or iPhone versions and Download the Sprive App

- Enter your name, address and your lender

- Sign up and enter promo code 55T86WEY

- Link a bank account. Note, this doesn’t need to be the account that pays your mortgage (don’t worry, it’s secure and uses Truelayer via open banking rules!)

- Set up a direct debit £1+ (£25 or more to potentially unlock the free £5) and Bob’s your uncle.

Within minutes, the app had illustrated potential savings and years or months that could be cut from my mortgage if I chose to assign a variety of saving amounts. The app also utilises an independent financial mortgage comparison service in the app which can be useful (they make their money via commissions from lenders if you switch).

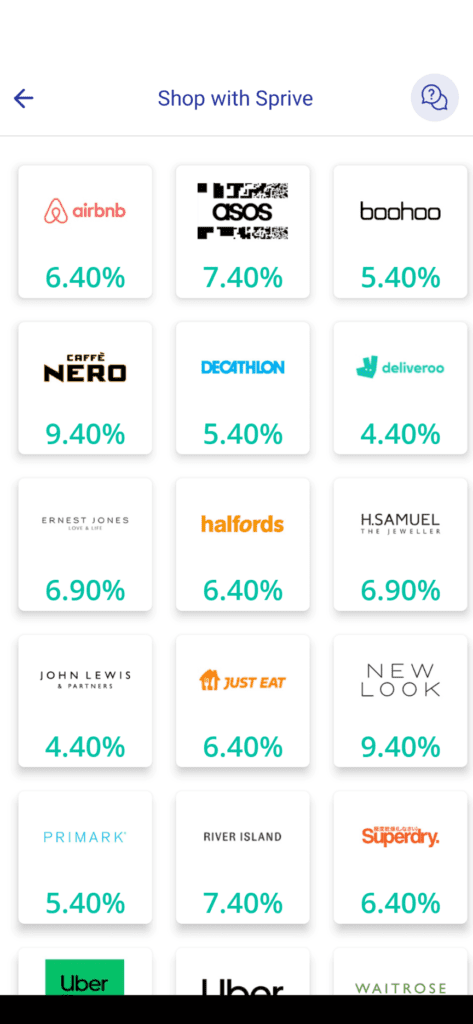

The extra bonus is Sprive’s cashback options on selected retailers if you additionally choose to shop via the app. This works in a similar way to many loyalty and workplace discount schemes, by allowing a percentage to be saved when you buy via Sprive’s payment partners. These savings can then be additionally paid off your mortgage balance via overpayments.

Example retailers that over cashback that can be applied to your mortgage include:

- AirBnB (6.4%)

- ASOS (7.4%)

- Cafe Nero (9.4%)

- John Lewis (4.4%)

- Primark (5.4%)

- Waitrose (2.4%)

- Costa (9.40%)

- Morrisons (3.4%)

- And many, many more…

These cashback offerings are on top of the Sprive app’s ability to use its algorithm in a similar way to Snoop (another app we’ve covered before in our money-saving and budgeting app reviews). It really does put users in control of taking back their financial freedom from a weighty mortgage balance.

But don’t just take my word for it. According to a study by Brian Tracy, one of the leading experts in personal development and productivity, setting specific, measurable goals and tracking your progress is key to achieving success in any area of life – including finances. And as I’ve found, using tools like the Sprive app and following the principles outlined by the FIRE movement can help make that happen.

Sensible budgeting, saving (using compounding) and clearing debts (via overpayments), really can set out a roadway to better financial wellbeing and Sprive just might help you get there.

I you’re looking to take control of your finances, pay off your mortgage earlier, and achieve financial independence and happiness, I highly recommend giving the Sprive app a try.

*Disclosure: This article is for entertainment and educational purposes only. Nothing on this site constitutes financial advice. I am not a financial advisor. You should always do your own research and consult a qualified financial advisor before making big decisions with your money as capital is at risk with any investment. This post may contain links to external sites and affiliates, Savvy Dad accepts no responsibility for how you use these external sites and services (see Site Terms and Privacy Policy).

Great I always overpay!

I think we need to consider overpayments soon, especially now our Help to buy scheme is ending and we will have remortgage that in. Will look into Sprive to help us. Thank you for the recommendations

Some very good thoughts!

Some really good advice

Good idea