Rishi Sunak’s Eat Out to Help Out Vouchers & Stamp Duty Cuts

Last week saw the Chancellor of the Exchequer, Rishi Sunak, launch his new stimulus package to support, protect and create jobs following the initial Covid-19 outbreak. The Chancellor’s full plan can be found in the government document “A Plan for Jobs” (CP 261). It’s aim is to be an all out boost to the hardest hit sectors of the economy and allow people to get out spending again to assist these sectors. However, for all the good news in the plan, who will the initiatives and stimulus help most and will they be worth the inevitable tax hikes in the autumn? What are Green Homes Grant, the new Nil Rate Band changes and the Eat Out to Help Out vouchers and lists people are talking about? Read on to find out…

How does the Sunak Mini Stimulus Budget support jobs?

The Chancellor of the Exchequer laid out ideas in the “Plan for Jobs” initiative to protect existing employees on the Furlough scheme and help them return to secure employment. His document also aimed to rejuvenate the employment rate for new recruitment via a KickStart Scheme.

In order to secure those on furlough in returning to consistent employment, Sunak’s plan laid out a “New Job Retention Bonus”. This will take the form of a bonus payment made to all employers who bring a furloughed employee back to work and keep them continuously employed until January 2020. The payment is set out as being £1000 for each and every furloughed employee brought back. It seems that Rishi Sunak is aiming to encourage employers to secure these jobs for as long as possible. Let’s just hope it doesn’t lead to a bumper number of redundancies after the January 2020 cut off period.

The kickstart scheme I mentioned earlier is a new fund worth a cool £2 billion. It has the aim of creating a huge number of jobs across the UK by effectively encouraging employers to engage with 6-month long work placements. It is mainly aimed at those thought to be at risk of long-lasting periods of redundancy, such as those in receipt of certain benefits like universal credit. The fund effectively covers a 25 hour week base-rate wage. This is a full fund, i.e 100% of the employed wage. Essentially, it’s funded work experience, with the hope that most employers will choose to keep staff on after the kickstart period.

There’s also an apprenticeship star model entitled “traineeships”. Over £100 million has been put into this fund in order to help with placements and training of 16-24 year olds. Rishi Sunak has said it will fund employers who provide trainees with work experience in a similar way to the retention scheme. A supportive £1,000 per trainee will be handed out to employers who hire new trainees.

A larger payment of £2,000 will be made to those employers for each new apprentice they hire aged under 25, and a £1,500 payment for each new apprentice they hire aged 25 and over, until 31st January 2021. In my view this is the perfect time for the government to guide employment sectors that are lacking staff numbers in order to generate a larger workforce such as care, education and green construction to support the green jobs initiative I’ll mention later. It’s also ideal for employment sectors where there is an ageing workforce population.

Rishi Sunak’s 2020 “mini budget” to help protect jobs encourages us to “Eat Out to Help Out” with vouchers.

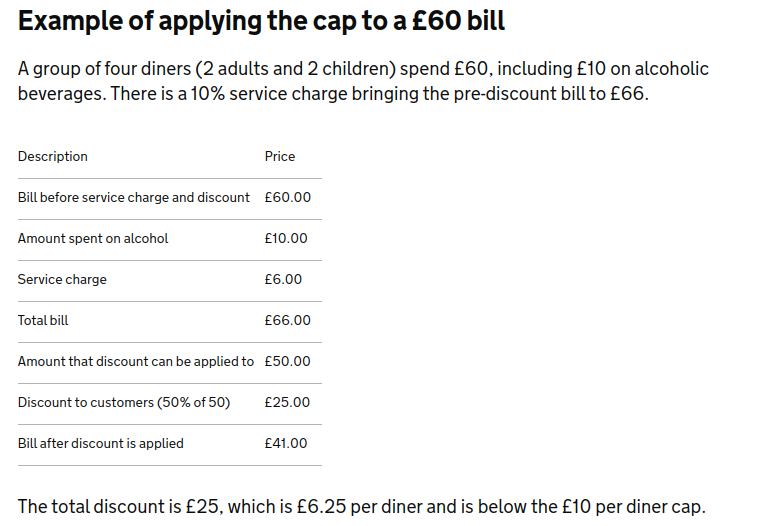

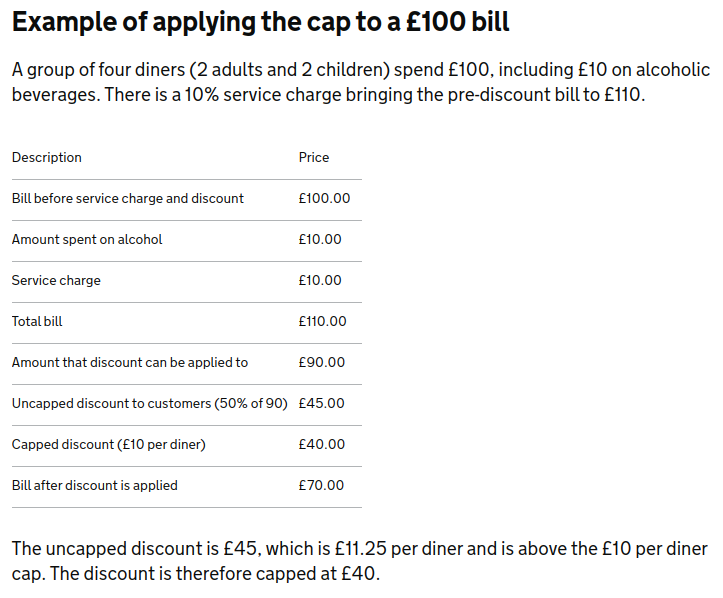

That’s right, after months of the government telling us not to go out, we’re now being encouraged to go out and to eat out to help out. The aim is to put in place a series of measures designed to increase demand in hospitality, restaurants and bars across England. So what is the Eat Out to Help Out list and what does it cover? Well, every England resident dining out will be entitled to a 50% discount of up to £10 per head on their meal. This is available at any participating restaurant on the eat out to help out list. It can be a café, pub or a number of other eligible food service establishments. The establishments where these Eat Out to Help Out vouchers are redeemed will be fully reimbursed by the government.

The discount, which will come into effect during August 2020, can be used unlimited times. It will be valid on food and beverages Monday to Wednesday on any eat-in meal (including on non-alcoholic drinks). There’s a chance it can be used alongside existing deals and discounts so check out my guide to using Meerkat Movies Meals and Codes

There’s also a temporary VAT cut on food, non-alcoholic drinks, accommodation and attractions in the UK. This means that from 15 July 2020 to 12 January 2021, a reduced rate of 5% VAT will apply to food and non-alcoholic drinks from restaurants, pubs, bars, and cafes. It also applies to supplies of accommodation and attractions. The main issue here we’ll be the transparency of pricing from food outlets and attractions as there’s no requirement to pass on this saving to their customers. They could effectively pocket the difference in VAT in order to put money back into their businesses, in turn helping to fill the void left by lost income during periods of lockdown closure. It will be interesting to see those restaurants and food outlets that balance customer appreciation with balancing their books.

The guidance states that these vouchers can only be used on dine in meals and services. However, they also say that if a customer orders food in a venue using the voucher and then decides to take away the remainder of the middle, the voucher discount is still valid. Whether some people use the loophole to get takeaway meals at half the price remains to be seen, ultimately the establishment will still get the full value recouped.

More details about the eat out to help out scheme, vouchers and list of those outlets included is expected to appear soon once businesses have applied to be included. For now, from a customer point of view, the main thing to know is the discount is 50% up to £10 per diner. The definition of “diner”, in the government’s eyes, is someone consuming food or beverages; not necessarily the bill payer.

eg.

“Where there is more than one diner on a single bill, the cap does not need to be calculated for each individual diner based on their specific orders. Instead, the discount that is applied to the overall bill should be capped at the number of diners multiplied by £10.”

Ie – You go to the pub for a meal with five people, the maximum discount will be £50. Even if only one pays the bill.

There are two specific examples listed on the government website to illustrate this discount usage:

Sunak announces Stamp Duty Nil Rate Band cuts and starts a Green Homes Grant to create jobs

Rishi Sunak’s economic stimulus plan also set out a number of measures to help with creating jobs in England. These measures were announced as a package intended to stimulate the housing market that’s been in a hiatus and boost new building and construction efforts.

The biggest of these measures to sure up the housing market is a temporary increase to the “Nil Rate Band” for non-commercial SDLT. This is valid immediately in England and Northern Ireland and is valid on properties up to £500,000 in value. Previously, the cut off point for the Nil Rate Band would have been £125,000. The Temporary Stamp Duty Land Tax (SDLT) cuts will apply from 8th July 2020 until 31st March 2021. This will include those mid-way through a house buying process but sadly miss those who completed during the initial pandemic and before July 8th 2020. Stamp Duty LAnd Tax (SDLT) still applies to those homes and properties valued over £500k.

Examples of SDLT percentages and value brackets from July 8th 2020 to March 31st 2021

Less than £500k – No SDLT

£500k to £925k – 5% SDLT

£925k to £1.5m – 10% SDLT

Over £1.5m – 12% SDLT

The other package the government is bringing in is a £2 billion Green Homes Grant. This will provide at least £2 for every £1 homeowners and landlords spend to make their homes more “green”. Essentially the recommendations most homes have on their EPCs (Energy Performance Certificates) will now be subsidised by the government in order to make homes greener and more efficient, while stimulating a green work industry. These Green Homes Grants will be available on energy efficient work and improvements up to £5,000 per household. For those England and NI residents on the lowest incomes, the scheme will fund 100% of these energy efficiency measures of up to a value of £10,000 per household.

What do all of these positive measures mean for the autumn budget?

It will likely come as no surprise that these huge stimulus packages will come at a cost in the autumn. Whilst there’s no real way of knowing what The Chancellor will announce in the autumn 2020 budget, we can expect the government to stop chlorine back the money is handed out. Most likely this will be via tax increases and adjustments to the triple lock on pensions which is unsustainable.

Rishi Sunak’s ‘plan for jobs’ is a very positive step to help get things moving again. However, it does leave a lot of work to do on balancing the books for the government and the Chancellor admitted that the Autumn 2020 Budget will set out how the government intends to bring the public finances back inline with what is sustainable for the future.

Typical politicians we get a scabby £10 off a meal 3 days a week for a whole month meanwhile they get a meal ticket for life!

It’s been a nice treat out with the family. I’ve only been out once for a meal, but it was worth it when we went out.