Free Printable Peak Money Saving Challenge for 2023

Saving challenges have grown in popularity recently. Across the net, I’ve seen the popular 365 day money saving challenge springing up everywhere in various forms. Many sites offer these free printable money saving challenges and they are popular in people looking to systematically fund the following year’s Christmas outlay. Or, to recover from the depressing finances of a previous December.

We all like the positive vibes of seeing a savings pot grow, it’s human nature. Brand saving schemes like Sainsbury’s popular Nectar scheme and their double-up event, show how this is the case.

I’ve also regularly seen people fail these free printable money saving challenges because of the way they are designed. In 2023, most will fail in their saving endeavours using these free challenges because of the nature of how costs, expenditures and inflation change during a year.

The traditional 365 day, 52 week saving challenge and why it fails

The most common saving challenge sets out the guidelines for saving an increasing amount every day. For example, on the first day, you’ll put 1p into a jar. On day two, you’ll add in 2p, and so on throughout the year. While you’ll amass a good amount if you succeed, it will mean you’re paying out around £25 a week in the last month of 2023. This last month is December, therefore it’s the time when most people are usually cash-strapped.

Similarly, the well-publicised 365-day £1 money saving challenge has potential flaws. This is where you’re putting in £1 in week 1, £2 in week 2 etc. It still ends up with weeks 48-52 requiring a staggering £200 from your funds at the worst time for finances. Let’s face it, for most in 2023, December is going to be the trickiest to save in – particularly if heating costs are rising and temperatures are dropping.

How the traditional 365 day or 52 week saving challenges compare

The 365 day 1p incremental saving challenge brings in a net £667.95 at the end of the year. (But gets more expensive as the year passes)

The 365 day £1 incremental per week challenge brings in a net £1378 at the end of the year. (But outlays over £200 in the last month)

Both offer a great ending pot, but so many fail in the more expensive months.

This is why we’ve invented a Savvy Dad 2023 free printable money saving alternative!

Keep reading…

Try the Free Reverse Saving Challenge or The Peak Challenge

You can adapt the previously mentioned challenges to start or end and other times of the year. This might help some savers, depending on their saving personality. But for us, we still wanted funds available for the winter pot for the family to use.

OPTION 1: The Free Peak Money Saving Challenge

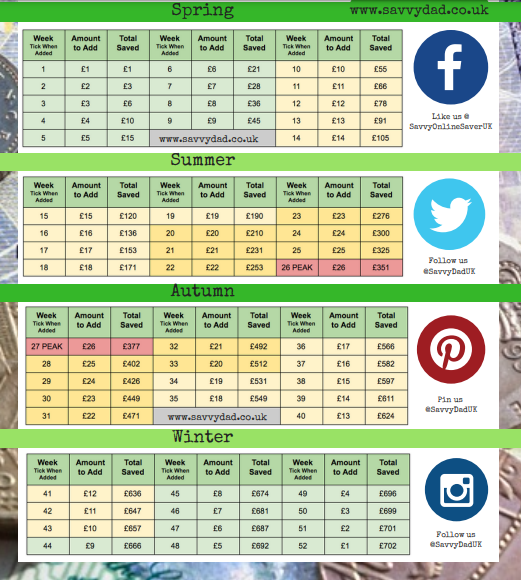

Start easy in January with £1 increments per week. Until week 26 where you’ll have raised £351. Then at that point, carry on saving week by week with decreasing amounts. Reducing by £1 a week from that point makes it at it’s most affordable in the last months. Making it manageable. You’ll have £351 from either side of the “peak”, meaning a £702 pot, which is realistic for most.

OPTION 2: The Reverse Printable Money Saving Challenge

This works with either of the traditional 365 money saving challenges. But it sets out to have the biggest outlays in the beginning of the year, meaning you’re getting the worst out of the way first. I’m a big fan of the book “Eat That Frog” by Brian Tracy. The American author sets out great methods for life that prioritise getting life’s biggest chores and tasks out of the way first. With this reverse money saving challenge, you are doing just that. You’re tackling the biggest, ugliest payments your going to face and popping them into your savings first. You’re “Eating that frog!” and making a great start to saving in 2023!

The reverse saving is pretty straight forwards. But, I’ve included below a free downloadable planner for my Peak Saving Idea, please do feel free to print them off and trial them. Hopefully, you’ll find these methods of saving truly effective at not only saving – but also succeeding.

It should be added that I’ve found this particularly useful for helping out with unexpected winter events like boiler issues. Having this pot meant I didn’t have to dip into the main family finances for anything.

Download our free printable money saving challenge PDF here (1mb download)

Please let us know during the year how you get on if you choose to try our saving challenge.

All the best with your saving successes.

5 Comments